Ira required minimum distribution worksheet 2021

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Ad Use This Calculator to Determine Your Required Minimum Distribution.

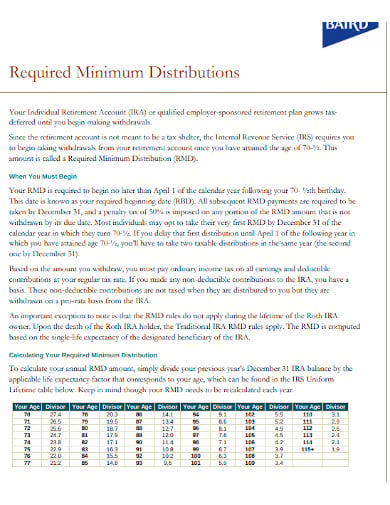

Khabar Navigating Your Required Minimum Distribution

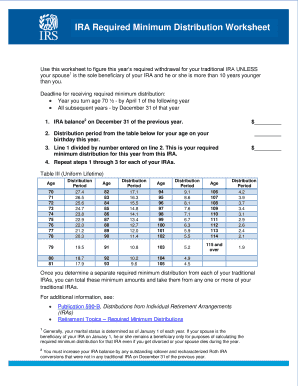

Deadline for receiving required minimum distribution.

. Opening an IRA May Help Meet Goals of Investing for Income or Growth. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Individuals with IRAs are required to begin lifetime RMDs from their IRAs no later than April 1 of the year following the year in which they reach age 72.

Refine Your Retirement Strategy with Innovative Tools and Calculators. Make a Thoughtful Decision For Your Retirement. Traditional IRA owners are subject.

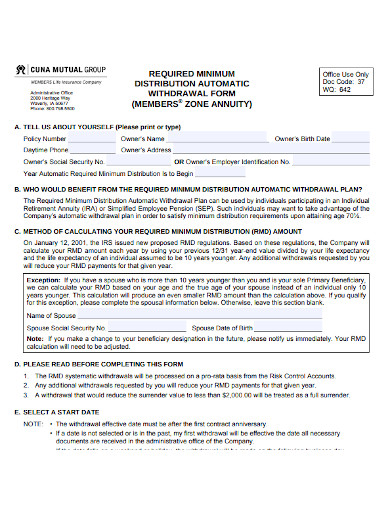

IRA Required Minimum Distribution Worksheet- Spouse 10 years Younger Use this worksheet for 2021 If your spouse1 is the sole beneficiary of your IRA and theyre more than 10 years. How do I avoid the Required Minimum Distributions. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you reach 72.

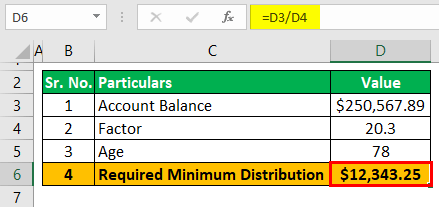

To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement. As a reminder an RMD is a minimum amount that must be withdrawn from a retirement account each year under certain circumstances. IRA Required Minimum Distribution Worksheet Use this worksheet for 2021 Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your.

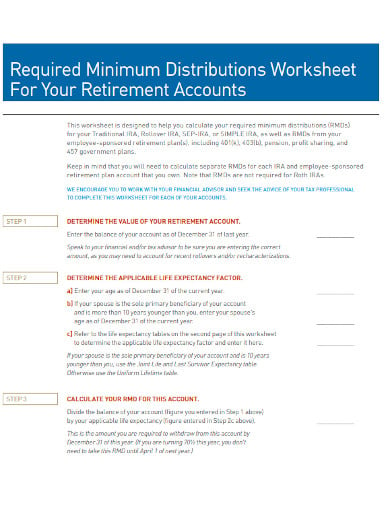

Your RMD worksheet 2 How to calculate your RMDs Step 1. April 1 2021 Due date extension. When do you need to take your RMD.

Divide the total balance of your account by the distribution period. The exception is the year in which you turn 72 when you have. Years younger than you use this worksheet to calculate this years required withdrawal for your traditional IRA.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. Complete Edit or Print Tax Forms Instantly.

Required Minimum Distribution Calculator. I n 2021 if you are age 75 with a 100000 Traditional IRA your RMD would be 4070. SECURE Act Raises Age for RMDs from 70 to.

Figure out the balance of your IRA account. Ad Register and Subscribe Now to work on IRS IRA Required Minimum Distribution Worksheet. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

Ou turn age 70 ½ - by. List each tax-deferred retirement account and the balance on December 31 last year. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

You reached age 72 on July 1 2021. IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA. Divide each balance by your life.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. How to calculate required minimum distribution for an IRA. The required distribution rules apply to.

Simple convert your Traditional. States Government English Español中文 한국어РусскийTiếng ViệtKreyòl ayisyen Information Menu Help News Charities Nonprofits Tax Pros Search Toggle search Help Menu Mobile Help. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your.

Individuals who reach 72 in 2021 and their 70 th birthday was July 1 2019 or later have their first RMD due by April 1 2022. The distributions are required. Ira Required Minimum Distribution Worksheet by Jordan Good - August 31 2021 Ira Required Minimum Distribution Worksheet.

Opening an IRA May Help Meet Goals of Investing for Income or Growth. Ad Paying taxes on early distributions from your IRA could be costly to your retirement. In general you need to fulfill your RMD obligation by Dec.

Find your age on the table and note the distribution period number. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distribution Calculator Estimate Minimum Amount

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

![]()

Required Minimum Distributions 10 Common Rmd Questions And Answers Beacon Capital Management

Required Minimum Distribution Rules Sensible Money

Tsp Required Minimum Distributions Rmds In 2020 And Beyond

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Where Are Those New Rmd Tables For 2022

Rmd Table Rules Requirements By Account Type

Irs Required Minimum Distribution Fill Online Printable Fillable Blank Pdffiller

Required Minimum Distribution Calculator Estimate Minimum Amount

2

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Inherit An Ira Recently Irs Revised Pub 590 B Corrected On May 25 2021